Barrantagh Canadian Equity Strategies

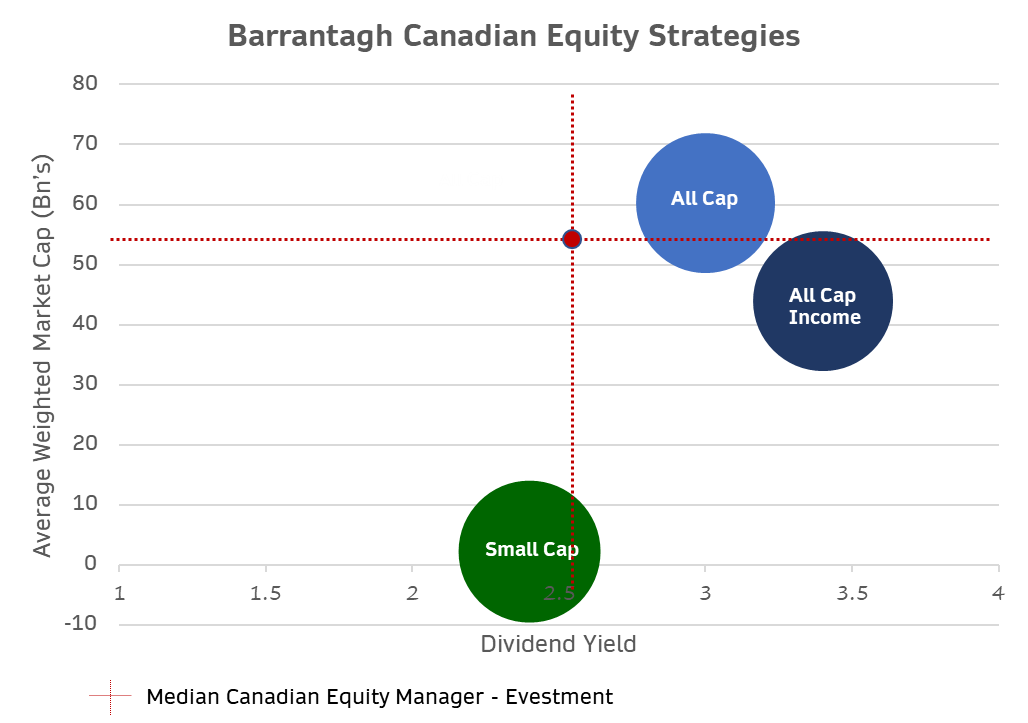

Barrantagh offers 3 distinct Canadian equity strategies. As value investors we expect our strategies to offer greater dividend yield than the marketplace. Our broad market strategies (All Cap, All Cap Income) cover the entire size spectrum or market capitalization available in the Canadian market, an approach referred to as “All Cap”. The Small Cap strategy is a superior diversification strategy highly differentiated by company size from typical large-cap Canadian equity portfolios. This strategy seeks to uncover companies that are less followed by the street and can offer growth rates hard to replicate in larger firms.

Growth of $100 Invested Since Jan/1985

1. Evestment Large Cap Canadian Equity

2. Evestment Small Cap Canadian Equity

Barrantagh Small Cap Canadian Equity

Investing in smaller companies exploits a less intensively researched part of the market and over market cycles these companies offer superior growth prospects – “the Small Cap effect”.

The average Canadian small cap manager grew $100 to $4,000 since 1985 – a 40-fold increase. This dramatically outpaced their large cap counterparts where assets grew 25-fold while the overall Canadian market rose by a factor of 17X.

To learn more about the diversification benefits of small cap please read our article: Diversification with Small Cap Canadian Equities, February 8, 2019

20 – 40 Security Portfolios “Best Ideas”

Broad Market Coverage

BIM All Cap Canadian Equities

- Fundamental value style, capital preservation

- Canadian Equities – 20-40 stocks

- Low turn-over

- Diversification: Minimum 7 GICS sectors

BIM All Cap Income Canadian Equities

- Fundamental value style, dividend focus, capital preservation

- Canadian Equities – 20-40 stocks

- Low turn-over, yield focus

- Diversification: Minimum 7 GICS sectors

Diversification Strategy

BIM Small Cap Canadian Equities

- Fundamental value style, capital preservation

- Canadian Equities – 20-40 stocks

- <$2Bn, > 1% Dividend yield at time of purchase

- Low turn-over, yield focus

- Diversification: Minimum 7 GICS sectors