Barrantagh Global Equity Strategy

Our global equity strategy offers exposure to key developed markets outside of Canada including the United States, Europe and Asia. Our successful balancing of “best idea” stock selection limits portfolio positions to 20 – 40 individual stocks. Our goal of bringing investments in some of the worlds best opportunities to our clients requires careful risk management through prudent diversification across geographies and industries. This strategy has delivered strong value added results over its benchmark and competitors, while maintaining a portfolio risk profile which is comparable with its competitor peer group medians.

Global Equity Strategy

- Fundamental value style, capital preservation

- Focused Global Equities – 20-40 stocks

- Global leaders + Special situations

- Diversification: Minimum 7 industry sectors

- Low portfolio turnover

- American Depository Receipts utilized for international exposure

Broadening Investments in Key Global Sectors

This offers Canadian investors exposure to major global industry sectors, which are focused areas of innovation, including Information Technology, Health Care, Industrials and Consumer Discretionary, sectors which collectively are a small portion of the Canadian stock market. Maintaining broad industry diversification is of particular importance in the prudent management of a focused portfolio, and we seek to moderate risk through the combination of uncorrelated investment opportunities.

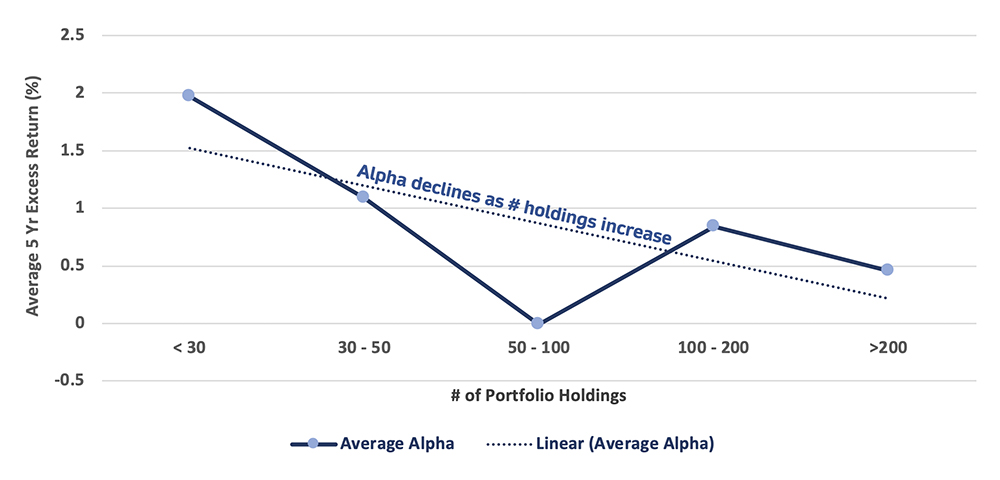

Focusing Global Equities to Best Ideas

Barrantagh conducted a study of global equity managers to examine their ability to add value over the market (excess return or Alpha) relative to the number of stocks held in their portfolios. The study summarized managers excess returns generated over a 10-year period and grouped global equity managers by their number of holdings in their portfolios. The results demonstrated that managers with <30 stocks delivered the highest excess return (+2%) while managers with >200 stocks delivered the least (50bps) over the last ten years. This is suggestive that at some point too many positions may be over-diversification and that some holdings might be diluting best ideas.

Average Rolling 5 Yr Excess Return (Q4 2009 – Q3 2019)