Investment Process – Disciplined Research

Our portfolios are all focused “Best Idea” portfolios which have delivered competitive value-added results that are driven by stock selection. Our quality value focus delivers low-risk profiles by avoiding “concept stocks” (stocks that may benefit from popular momentum and are valued beyond their net worth) in favour of measurable cashflow-based profitability, proven management and limited cyclical exposure. Portfolio candidates are assessed using our disciplined 5-Step Investment Decision-Making process. This is designed to rigorously assess a company’s ESG profile and management team while applying fundamental valuation principles to our price targets. Ultimately portfolio decisions are both independent and team-driven.

1. Screening – Company Snapshot

Proprietary datasheet providing insight to operations, cyclicality and key value creation drivers

2. Qualitative Analysis & ESG Profile – Initial Research

Develop initial thesis on company and fit with investment criteria

3. Management Assessment – Management Interview

Assess Management, gain further insight to strategy, business model, opportunities and threats

4. Company Valuation – Financial Model

Independent assessment of company and corroborate (or not) management narrative

5. Team Decision

Assess whether investment opportunity represents an attractive total return opportunity

Sustainability – Integrated Approach

We believe that corporate sustainability is directly related to a firm’s ability to deliver long-term growth in profit.

Sustainability – Engagement

Primary engagement with entities is via ongoing meetings and communications with managements/boards where we strive to share our views as investors and gain a better understanding of the company. As UN PRI signatories we also participate in collaborative engagements on select issues.

Environmental

- Climate change (Carbon/Greenhouse gases)

- Energy efficiency

- Water pollution

- Water/wastewater mgmt.

- Land use (biodiversity, habitat protection, site rehab)

Social

- Human rights

- Labour standards (health & safety, gender diversity, employee engagement, child labour)

- Indigenous rights (social & economic progress)

- Community impacts

Governance

- Board composition & independence

- Executive compensation

- Transparency

- Financial practices

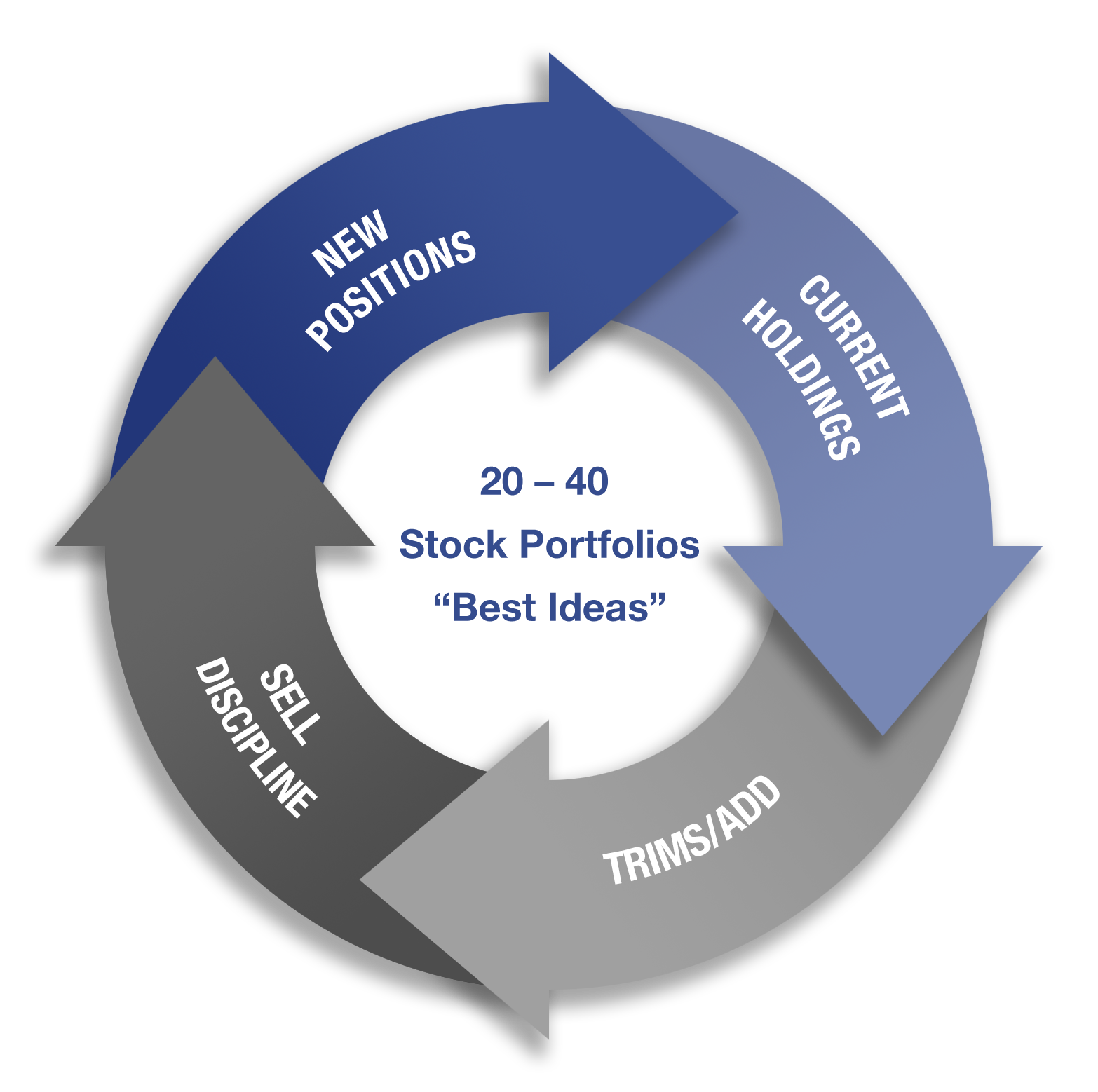

Team-based Decision Making

Weekly investment team meetings integrate equity and fixed income decision-making. Team meetings oversee the “life-cycle” of a stock or bond in their respective portfolios. The life of an investment in the portfolio is initiated with the “Buy” decision with subsequent ongoing monitoring and trim/adds of existing positions, and ultimately concludes with sale of a position. We believe that the portfolio should be limited to our best ideas and accordingly limit holdings to 20 – 40 securities per strategy.

New Positions

- 40% return potential over 3 years

- New ideas run through the 5-step assessment process.

Current Holdings

- Evergreen Buy/Sell price targets

- Company news/earnings updates

Trims/Adds

- Opportunistic management of existing positions

Sell Discipline

- Full valuation vs. sell target

- 20% under performance vs. peer group => price target review