Focus on Quality Value

Barrantagh employs a disciplined fundamental value investment approach. Simply put, we look for companies that are superior businesses managed by capable management trading at attractive prices. Risk within fixed income portfolios is managed within a layer of risk control bands around overall portfolio duration, yield curve distribution and corporate bond exposure. Within equity portfolios our fundamental research process controls risk from the bottom-up by focusing on quality value. This is a combination of a bias to full cycle profitability, low capital intensity, strong balance sheets, management assessment and entry points when companies demonstrate value vs. their peers and their own valuation history.

Superior Businesses

- Competitive advantages

- Industry leaders

- Pricing Power

- High return on capital

- Low capital intensity

- ESG Profile

Attractive Valuation

- Cashflow analysis

- Independent valuation

- Forecast use of leverage

- Quality reduces risk

- Buy/Sell Targets

Capable Management

- Aligned with shareholders

- Clear business strategy

- Record of value creation

- Low cost operators

- Conservative use of leverage

Why we Invest in Quality

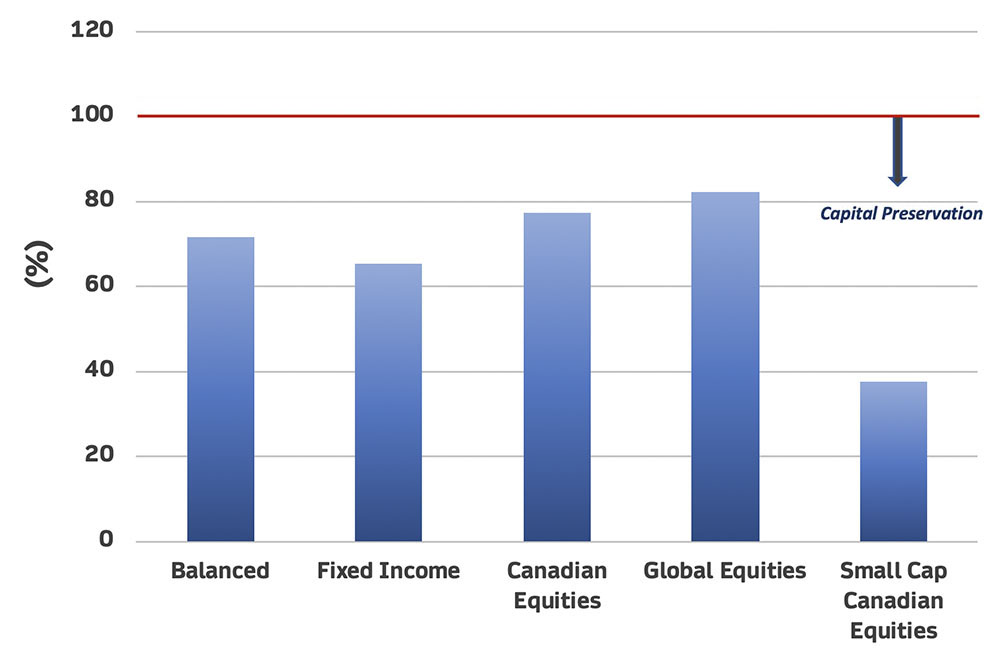

Capital Preservation

Our ability to measure our defensive approach to investing can be illustrated using a statistic known as Down Market Capture (DMC). DMC results < 100{3ecd1be486a9e87a4f4369018c2c82e0b20ae56f3805f05eebdf95b8ef27da05} are desirable indicating portfolios avoid negative events relative to the market itself. This effectively measures capital preservation in falling markets. Consistently applying our quality value investment philosophy delivers less exposure to falling markets across our product offering. Our focus on quality delivers protection in falling markets while capturing 100{3ecd1be486a9e87a4f4369018c2c82e0b20ae56f3805f05eebdf95b8ef27da05} of rising markets. Capital preservation is in our investing DNA.

Down Market Capture

Barrantagh Strategies Since Inception

(at Dec. 31, 2019)

Down Market Capture

Barrantagh Strategies Since Inception

(at Dec. 31, 2019)